21 August 2024 Press | Social Infrastructure

PPPs Central role in Italy’s economic recovery

Equitix team, Milan talks to Partnerships Bulletin about the role of PPP in supporting Italy’s economic recovery

Re-evaluation of risk and rejuvenation of the PPP model could prove key to Italy’s pandemic recovery.

If necessity is the mother of invention, then as far as PPPs in Italy go, recent context has been the architect of rediscovery.

PPP is certainly not a new concept in the country, with the first law covering the model issued in 1994, although in comparison to other European nations, its use in large infrastructure projects has been limited. Claudio Golino, Deloitte’s central Mediterranean energy, resources & industrial lead, attributes that partly to “regulatory and bureaucratic hurdles that have limited the scope of such partnerships”. There are also similarities with places like the UK, where the deterioration of the reputation of PPP and the politicisation of its application have driven down its popularity. Yet, it appears that’s a luxury no longer available to the Italian public authorities – an eventuality brought about by the massive economic impacts of the Covid-19 pandemic. “The urgency and scale of the Covid crisis demanded a revitalized collaboration between public and private actors,” explains Golino. “PPPs became essential to provide a rapid response and effective resource mobilisation, revitalising their role in the Italian economy.”

Another important legacy of Covid has been a rebalancing of risk. Oriana Granato, partner and head of projects and infrastructure at EY Studio Legale Tributario, says: “After Covid, most PPP agreements needed to be renegotiated due to a force majeure event. This has given both the awarding authorities and concessionaires the opportunity to reopen their contractual relationships in which – in several cases – the risk allocation was not correctly balanced between the two parties. This has given new life to PPP agreements.” What’s more, the EU initiatives to address the financial consequences of the pandemic have created a landscape in which PPP can be a game-changer: Italy’s national recovery and resilience plan (NRRP) is the largest national plan under Next Generation EU (NGEU), the European Union’s post-pandemic plan to boost member states’ economies. NGEU has allocated €194.4bn (or 10.8% of the country’s 2019 GDP) of EU resources in grants and loans to Italy.

However, deadlines to use this funding are set at August 2026 and given that Italy had spent only 22% (€43bn) of those funds by the end of 2023, the timelines are challenging. Perhaps no wonder then that, in April 2024’s ‘Italy’s National Recovery and Resilience Plan Latest state of play’ the European Parliament quoted Carlo Bonomi, President of Confindustria (the association representing manufacturing and service companies in Italy), as saying that PPPs are the only way to make a success of the unique opportunity offered by the plan. Golino agrees: “Public-private partnerships are essential for the success of this plan as they bring together the strengths of both sectors – public oversight and private efficiency. This collaboration can drive innovation, ensure effective use of funds, and achieve the ambitious targets set by the NRRP.”

Nunzio Bicchieri, partner at Norton Rose Fulbright, adds: “The purpose of the NRRP is to achieve more robust, sustainable and inclusive economic growth. Amongst the tools envisaged to boost the economy, especially in the infrastructure sector, PPP plays a key role.” He continues: “Whilst in some European countries that pioneered the PPP market, PPP is in retreat, in Italy it is constantly increasing, both in terms of value and volume.”

One of the NRRP’s objectives has been the enactment of a new public procurement code, which has now been in place for just over a year and is aimed at reducing what Golino refers to as “bureaucratic hurdles that have historically hindered the effective use of PPPs”. Ashurst partner, Elena Giuffrè, describes the code as offering “a favourable legislative framework related to the adoption of the PPP scheme, which represents a great support and incentive for their use in the development of new projects and initiatives”. “In particular,” says Bicchieri, ”the new code simplifies the recourse to PPP in order to make it more attractive for both the private and public sectors.”

Golino describes it as “focusing on economic rationale and the transfer of operational risk to the private sector; allowing the leverage of various contractual types (in particular the concession scheme); broadening the scope of what can be considered a PPP and expanding the sectors of application (e.g. transportation, energy and waste, digital and telecom, sports and stadiums); facilitating the use of PPP, particularly by promoting PPP’s central role in Italy’s economic recovery standardised procedures that offer greater clarity to both authorities and private parties, enhancing the bankability of projects and thus creating a leverage effect that can ensure adequate remuneration for private contributions, generating a virtuous circle.”

In addition, over the past couple of years, he has seen the government’s Department for the Coordination and Economic Policy Planning (DIPE)“actively promoting the use of PPPs and providing technical support to public administrations. This includes assistance in the preparation of feasibility projects, evaluation of proposals, negotiation of contracts, and ensuring the correct allocation of risks.”

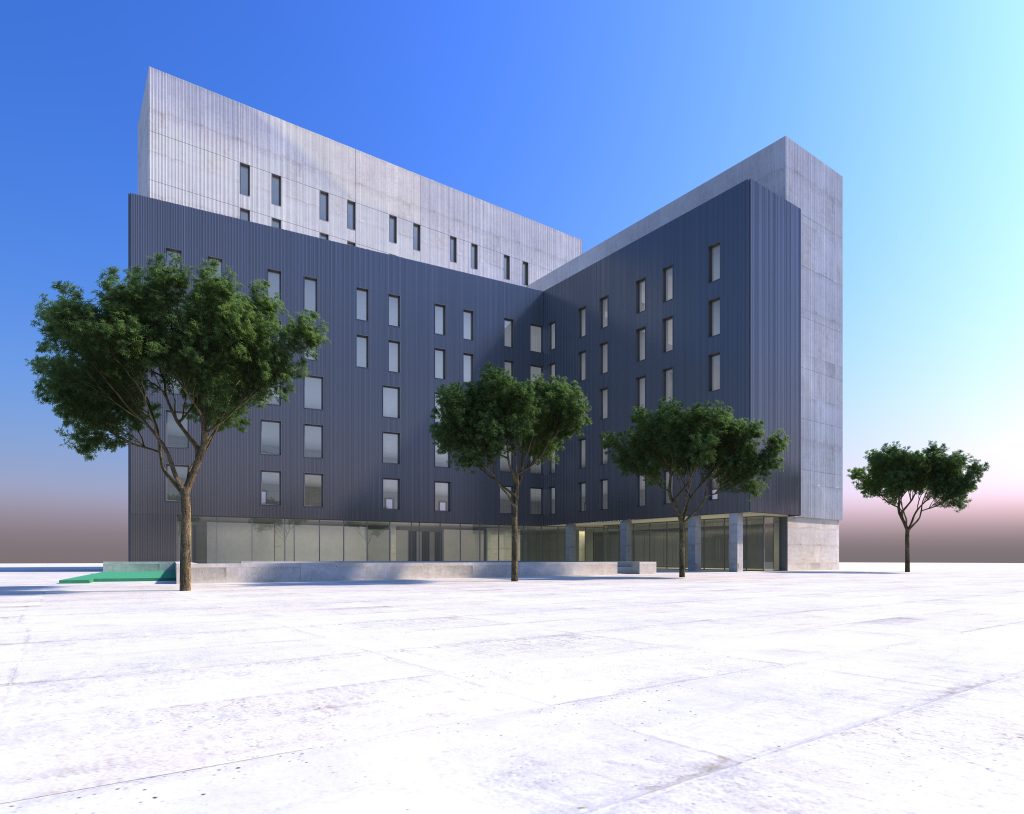

The assistance offered by DIPE is crucial. Giuseppe Scianti, director of asset management and Michela Ghirardini, director of investments in the Milan office of Equitix, agree that the NRPP has certainly opened up new opportunities and a growing interest in PPP. Equitix has been present in Italy since 2015, when it acquired the concession for the Castelfranco and Montebelluna hospitals and since expanding its AUM with other hospitals fora total of over 4,000 beds for a total of approximately £300m, meaning it has seen the market’s evolution in recent years. However, both point out that “the issue that we encounter can often be within the governing departments responsible and a lack of resource required to evaluate and manage these projects, given the length of time required to execute them efficiently.”

For them, it’s important to remember that working on PPP projects effectively “requires an understanding of the project, expertise, tenacity and above all, to be open to innovation to exercise the function of commissioning efficiently. Working with private investors is often the value-add which can make these projects excel.”

While Granato notes that the Italian government has now recognised that PPP is critical “to cover the percentage of capital investments which will not be covered by the NRRP”, she also points out that “NRRP funds have often been allocated to infrastructure projects that were per se bankable, which may not have necessitated substantial public funding.” She concludes: “There is substantial margin for a more strategic application of PPP arrangements to enhance the effectiveness of NRRP funds.”

Investor appetite

There is also more room for improvement in what Scianti and Ghirardini label the “modest size of the individual initiatives and certainly the timeframes”, which they say “remain well above the European average and which -combined with the persisting risk of challenge with respect to potential tender results – contribute to the fact that international financial investments are not yet massively attracted”.

Nevertheless, PPP is clearly becoming increasingly pivotal in public investment choices. Figures quoted by Scianti and Ghirardini amply evidence this: “The share of recourse to the PPP in 2023 reached 19.4% of the total value of tenders (for works and services), up seven percentage points compared to 2020: for projects exceeding €100m, PPP represents over 30%of contracts.” Granato cites, “hospitals, energy efficiency of public owned real estate assets and waste to energy” as “the sectors in which we notice a particular increase of PPP initiatives”. Bicchieri refers in particular to having recently been involved with “several PPP transactions relating to roads and hospitals, demonstrating huge appetite from both lenders and investors”.

Another key focus of PPP is currently on sustainability. Around €60bn – or37% of the Italian NRRP – is earmarked for the ‘Green Revolution and Ecological Transition’. “Sustainability goals have widened the use of PPPs, ”says Bicchieri, “especially in relation to projects involving renewables, as well as decarbonisation in the hard to abate industries and energy efficiency for public buildings. All these sectors require a cooperation between the public and private sectors to achieve the agenda under the EU green deal and its implementation at national level.” In fact, the inclusion of socio-environmental sustainability objectives (‘Value for Society’) within the PPP scheme, implies what Golino calls “a shift from the traditional ‘Value for Money’ approach (based on evaluating and selective the bidders offers according to the best value for money criteria) towards an holistic approach considering the sustainable value for the community.”

Other current positives include the recent increase in the number of unsolicited proposals seen by Scianti and Ghirardini.

Umberto Antonelli, partner at Ashurst, is also encouraged by the mitigation of challenges faced by greenfield PPP infrastructure projects in the last few years, due to the extraordinary increase in raw materials prices, as a result of the Russian/Ukrainian conflict and the increase of the financing cost. The solution, he states, “was addressed through a rebalancing of the key economic drivers of the PPP scheme agreed by the competent authorities combined with other economic measures approved by the government, a further demonstration of the support of the relevant public entities and the government in the development of such infrastructure”.

Overall, Golino views the outlook for Italian PPPs as promising. “With ongoing support from the EU, a focus on sustainable development and improved regulatory frameworks, PPPs are set to play a critical role in Italy’s economic recovery and long-term growth,” he suggests.

This sits within a context of “limited public resources for funding investments in public works, limited technical expertise within public administrations for designing and developing projects and lengthy bureaucratic processes” and crucially, recognition at the highest levels of Italian government of the expertise, efficiency and speed with which PPP can bring critical infrastructure projects to fruition.